This is post two in a series on industry analysis.

Find the hidden industries. Let us take the example of bus operators and taxi operators in Singapore. The supply chain around bus operators is quite simple. Bus manufacturers (e.g. Scania, Daimler) sell their buses through their own sales force directly to the bus operators (i.e. SMRT, ComfortDelgro). The bus operator operates the routes and the end-customer pays a fare once he enters the bus. In the figure below each box represents a separate industry. The implicit assumption is that there is a market for the goods or services at each stage of the industry supply chain.

In contrast, the supply chain around taxi operators is much more complex. First, the automotive manufacturers (e.g. Toyota, Hyundai, Mercedes) sell their cars to independent distributors. Those distributors then supply the cars to the taxi operators (e.g. ComfortDelgro, TransCab, SMRT). The taxi operators outfit the car to a taxi and then rent it out to taxi drivers. The taxi driver is charge a daily rental fee. The end-customer is a customer of the taxi driver and not the taxi operator.

In contrast, the supply chain around taxi operators is much more complex. First, the automotive manufacturers (e.g. Toyota, Hyundai, Mercedes) sell their cars to independent distributors. Those distributors then supply the cars to the taxi operators (e.g. ComfortDelgro, TransCab, SMRT). The taxi operators outfit the car to a taxi and then rent it out to taxi drivers. The taxi driver is charge a daily rental fee. The end-customer is a customer of the taxi driver and not the taxi operator.

|

| Industry supply chains of bus operators and taxi operators |

Without understanding the whole industry supply chain, it is impossible to get a good understanding of power relationships in the industry supply chain. A full understanding of the industry supply chain will also make it easier to craft new, unique strategies. A profit pool diagram is often a useful way to graphically represent where the profits are made in an industry supply chain. The area of each box show how much operating profit is made by each stage in the industry supply chain

Follow the money. The industry supply chain should be drawn with upstream or supplying industries to the left and buying industries or end-customers to the right of the focal industry. This convention does normally not cause any problems. However, there are certain situations where it could be somewhat confusing to decide whether an industry is supplying or buying. When in doubt, always follow the money flow. Any company that pays the focal company is a buyer and any company which the focal company pays is a supplier.

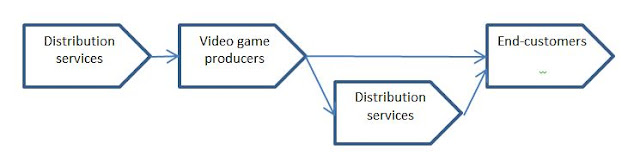

The video game production industry can serve as an illustration. Distribution services can take many different forms. The traditional format is when a retailer takes ownership of the video game and then sells it to the end-customer. With the rise of the Internet, this step in the industry supply chain could be bypassed by the video game producers by selling downloads directly to the end-customer. Finally, with the rise of social network websites, the distribution services can be a supplier. If a company uses Facebook to distribute its games to end-users, then it must pay Facebook. Facebook never takes ownership of the video game, but merely functions like a middleman taking a commission. This simple example illustrates that the economic activity distribution services can be organised very differently (supplier, within focal industry, or buyer). Since the different companies in an industry can have different arrangements it is often common that various distribution solutions exist in parallel in an industry.

A similar situation exists in the public transportation example discussed above. The taxi driver is a buyer (pays the focal industry), while the bus driver is a supplier (gets paid by the focal industry).

In industry analysis it is advisable to follow the trail of money that flows between the different stages. The money flows in the opposite direction of the arrows. Anything that is directly to the left of the focal firm will sell something to the focal industry. Anything that is directly to the right of the focal industry will pay the focal industry. It is possible to draw these diagrams following the flow of products instead. That is a different approach that typically is used in the operations management. It is not advisable to use such flow charts in industry analysis.

Start with the important industries. When describing the industry supply chain it is important to use the 80-20 rule, i.e. focus should be on covering the most important parts of the industry supply chain first. Any industry that extracts a large portion of total value created in the industry supply chain must be mapped. Naturally, the amount of details in an analysis will vary based on the objective of the analysis.

The figure below shows two different levels of detail for the taxi operator industry. A more detailed analysis will always provide extra benefits, but the benefits have to be weighed against the extra cost of a more detailed analysis. In the case of taxi operators, the benefits of the more detailed specification of buyers is limited as advertising revenue is relatively small compared to the taxi rental revenue.

The above analysis might lead one to believe, by analogy, that the same conclusion would apply to the bus operator industry. It is always dangerous to make such an assumption. In fact, the advertising revenue received from advertising on buses and bus stops is quite substantial. Because the bus fare is regulated by the government, the share of profit generated by advertising services is even higher.

|

| First draft of profit pool illustration of the taxi services industry supply chain. |

Follow the money. The industry supply chain should be drawn with upstream or supplying industries to the left and buying industries or end-customers to the right of the focal industry. This convention does normally not cause any problems. However, there are certain situations where it could be somewhat confusing to decide whether an industry is supplying or buying. When in doubt, always follow the money flow. Any company that pays the focal company is a buyer and any company which the focal company pays is a supplier.

The video game production industry can serve as an illustration. Distribution services can take many different forms. The traditional format is when a retailer takes ownership of the video game and then sells it to the end-customer. With the rise of the Internet, this step in the industry supply chain could be bypassed by the video game producers by selling downloads directly to the end-customer. Finally, with the rise of social network websites, the distribution services can be a supplier. If a company uses Facebook to distribute its games to end-users, then it must pay Facebook. Facebook never takes ownership of the video game, but merely functions like a middleman taking a commission. This simple example illustrates that the economic activity distribution services can be organised very differently (supplier, within focal industry, or buyer). Since the different companies in an industry can have different arrangements it is often common that various distribution solutions exist in parallel in an industry.

A similar situation exists in the public transportation example discussed above. The taxi driver is a buyer (pays the focal industry), while the bus driver is a supplier (gets paid by the focal industry).

In industry analysis it is advisable to follow the trail of money that flows between the different stages. The money flows in the opposite direction of the arrows. Anything that is directly to the left of the focal firm will sell something to the focal industry. Anything that is directly to the right of the focal industry will pay the focal industry. It is possible to draw these diagrams following the flow of products instead. That is a different approach that typically is used in the operations management. It is not advisable to use such flow charts in industry analysis.

Start with the important industries. When describing the industry supply chain it is important to use the 80-20 rule, i.e. focus should be on covering the most important parts of the industry supply chain first. Any industry that extracts a large portion of total value created in the industry supply chain must be mapped. Naturally, the amount of details in an analysis will vary based on the objective of the analysis.

The figure below shows two different levels of detail for the taxi operator industry. A more detailed analysis will always provide extra benefits, but the benefits have to be weighed against the extra cost of a more detailed analysis. In the case of taxi operators, the benefits of the more detailed specification of buyers is limited as advertising revenue is relatively small compared to the taxi rental revenue.

|

| Further analysis will lead to a more detailed industry supply chain |

The above analysis might lead one to believe, by analogy, that the same conclusion would apply to the bus operator industry. It is always dangerous to make such an assumption. In fact, the advertising revenue received from advertising on buses and bus stops is quite substantial. Because the bus fare is regulated by the government, the share of profit generated by advertising services is even higher.

1 comment:

I really liked your Information. Keep up the good work. Tim hornibrook

Post a Comment