Market shares. Compared to many other countries of a similar size the overall market has a larger other category (e.g. open air wet market, dry markets, convenience stores).

Price levels. The price level for a fairly identical basket of goods varies considerably between the different firms. Likewise, the product range varies considerably in number of stock keeping units, a measure of the range of products carried.

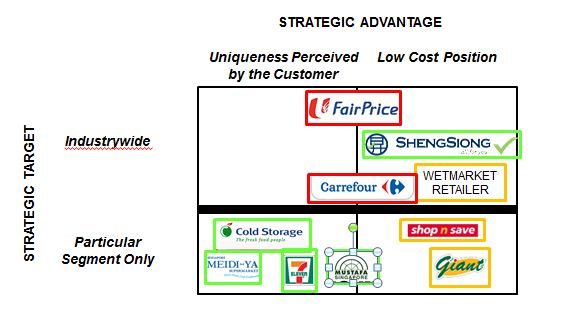

Overview of generic strategies. Most of the strategies can clearly be mapped on Porter's generic strategy framework. The following discussion will highlight a few individual cases.

|

| Subjective assessment of generic strategies in the Singaporean grocery retailing space. |

There are a lot of well-positioned companies focusing on a particular segment of the market. These companies have fairly unique position in the market place and face less competition.

- Cold Storage. Catering to the well-off Singaporeans and Western expat communities. Location in more expensive neighbourhood. A decent range of both local and western produce. Carries a lot of processed food (ready to cook pasta, grilled chicken). Clear leader in this segment, but Fairprice also has a few outlets in this segment (Fairprice Finest).

- Meidi-Ya. Catering to the Japanese expat community. A range of air-flown Japanese produce, but also a fairly extensive range of western produce. One outlet. One of two companies focusing on this segment.

- Mustafa. Catering to the people with an ethnic origin in South Asia, but also popular among Singaporeans in general. One outlet open 24 hours. A broad range of Indian and Middle-Eastern produce, but also carries a lot of non-food items. Only company with this focus.

- 7-Eleven. A traditional convenience store. One of two chains plus a lot of independents with this focus.

- Giant. A hypermarket with fairly low prices. Located in suburban areas, but some outlets are close to public transportation. Singapore is land-constrained and most households do not own a car. Thus this format is less important in Singapore compared to many developed countries. Only company with this focus. Whether this strategy should be classified as a niche strategy or a industry-wide low-cost strategy is open to debate.

The following companies can be argued to use a low-cost strategy. Only the lowest cost company will provide a good return on investment. This is based on the theory that only one company will be able to do well when the competition is focused on cost.

- Sheng Siong. The company with the lowest prices. Has a full range of fresh fish and vegetables to suit local tastes. Carries both halal and nonhalal meat to appeal to all races in Singapore. Location of outlets in the heartland (high-rise apartment blocks). The company uses many clever strategies to keep cost down. (1) Sourcing directly in China and more recently Vietnam. In general without any middlemen. (2) Systematically run out of some fresh produce in the late afternoon. Pork is butchered in the morning and sold behind the desk until around noon. Thereafter, remaining items are shrink wrapped. In the evening the preferred cut are all gone and customers will pick the remaining cuts (or buy frozen pork). A similar principle is used for fresh vegetables and fish. Very limited assortment of western produce.

Shop n' Save.A traditional low price company. Low cost is achieved by having a very limited assortment of products, especially fresh vegetables and meat. Very limited assortment of western produce.- Wet markets. These are independent retailers focusing on one kind of produce (e.g. chicken, pork, fish, fruit, vegetables). Their price level is generally low, but sometimes the focus is more on quality than price.

- Swanston. I am not really familiar with this company but I have seen their outlet in Chinatown. They are purely focusing on personal care and household cleaning products and have even lower prices than Sheng Siong. It is an example of low-cost focused strategy.

The following companies have a very problematic strategic position:.

- Fairprice. Has a price level closer to the low-cost strategy companies, but a cost structure more similar to ColdStorage. They have also publicly stated that their prices are the same irrespective of the wealth level of the neighbourhood. While such a strategy will make customers happy it is not likely to result in a high profitability. Fairprice is linked to the trade union so it is not a fully commercially oriented company. However, Fairprice is an established company that possess very good locations in the heartland of Singapore. Good locations will dampen the negative consequences of Fairprice no longer having the lowest price items.

Carrefour. Prior to exiting the Singapore market, the company had two hypermarkets in central locations. During their time in Singapore they tried different strategies. At one point they had a low price guarantee, but at the time the data were collected it had moved away from that strategy. So prior to closing, the company had a very confusing positioning in the market place. They appealed to local tastes by selling fresh fish and meat, but they were located in fashionable central shopping mall where customers typically do not shop for groceries. They did not carry a broad range of products produced by the French parent company. Instead they focused on supplying both local foods as well as food for the large US/Australia/UK expat communities.

What will happen?

- The niche companies will continue to thrive along with their niche audiences.

- Sheng Siong is a relatively young company and is still suffering from a lack of well-positioned retail locations. This will change over time, but slowly. They are able to turn a profit as well as having the lowest prices. They have cleverly designed a low cost value chain without doing the standard trade-off done by Shop n' Save (remove fresh produce) and Giant (suburban locations). Its shares are likely to be a good long term investment.

- Fairprice has recently met competition from the more entrepreneurial Sheng Siong, which renders Fairprice stuck in the middle (a label used for a company that tries to both be differentiated and low cost). They will survive due to being a cooperative and being in possession of superior retail locations. However, their market share relative to Sheng Siong will suffer slowly. (However, it is perfectly possible that both will gain market share at the expense of the Other category.)

- Carrefour was a company blatantly without a strategy and also stuck in the middle. The company exited the country in the autumn 2012.

- Wet markets. This very traditional retail segment will continue to shrink in size. Some aged vendors will go out of business when they retire and a few more entrepreneurial vendors with reposition themselves in the higher-end of the market (quality, fresh produce).

Updates

Shop 'n Save and Giant are owned by the same corporate parent. Recently, they decided to merge the two chains under the Giant name. It is likely that Shop 'n Save suffered in competition with Sheng Siong. And it is likely also that Giant's hypermarket concept did not have a lot of growth potential left. Hypermarkets generally require the customers to have a car. My guess is that the result will look more like Sheng Siong (May 2013).

No comments:

Post a Comment